Summary

Many Americans are working hard and saving diligently, yet feeling like their money just doesn’t go as far anymore—and they’re right. The blog explains that the U.S. dollar has lost over 96% of its value in the last century, with over a quarter of that loss happening in just the past 15 years. Inflation, excessive money printing, and eroding savings are key contributors. Most people are still following outdated financial advice while the wealthy are turning to modern income-generating systems like the Tardus Income Snowball. The article emphasizes that building real financial freedom isn’t about being rich—it’s about being prepared, having a smarter plan, and taking action before it’s too late.

You’re working hard, saving diligently, doing all the “right” things… but your dollar doesn’t stretch as far as it used to. Groceries cost more, rent is climbing, and even your morning coffee has inflation anxiety.

If you’ve felt like your money is losing power, it’s not in your head. It is.

And the bigger problem? Most people are still trying to play a financial game with 1980s rules. In a 2025 economy.

Let’s break this down into 3 big truths—and how to flip the script starting today.

1. The Dollar Is Quietly Shrinking And It’s Not Slowing Down

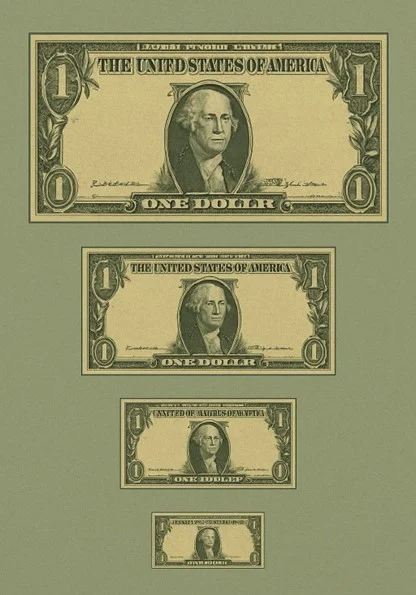

The U.S. dollar has lost over 96% of its value in the last century. But even more shocking? Over 25% of that loss happened in just the past 15 years.

Why?

- Inflation: The cost of living keeps going up while wages struggle to keep pace.

- Debt & Printing: The government continues to print money, adding fuel to the inflation fire.

- Savings Erosion: That “safe” savings account you were told to build? It’s silently bleeding value year after year.

According to Forbes, keeping cash in a traditional savings account could be the slowest form of financial self-sabotage.

2. The Rules Have Changed But Most People Haven’t

Here’s the truth bomb: Traditional financial advice is outdated.

Saving more, cutting lattes, or maxing out your 401(k) isn’t enough. Not when the value of your money is dropping and the cost of living is soaring.

The wealthy aren’t relying on hope—they’re using systems. Predictable, passive incomeproducing systems like Tardus’ Income Snowball, which helps you grow wealth without burning time or taking wild risks.

Want a deeper dive into how our clients do this? Start with our post on how average earners build real income.

3. It’s Not About Being Rich It’s About Being Ready

You don’t need a finance degree or a trust fund. You just need a plan.

One that:

- Aligns with your values

- Works with the income you already have

- Doesn’t require tapping into savings or playing stock market roulette

And if you’re thinking, “But isn’t it risky?”—let me ask you this: How risky is staying the same? How much is inaction costing you, month after month?

We help clients realize that staying stuck isn’t safe—it’s expensive.

Here’s Your Move

If you’ve been feeling the pinch of inflation or watching your dollars dwindle and wondering, “What else can I do?”—you’re already asking the right question.

Now it’s time to get the right answer.

Join our free mini-training on how to create real income using the Tardus Income Snowball. It’s not a get-rich scheme. It’s a get-control-now strategy.

Start your path to passive income

And if you want to explore how the dollar’s decline is reshaping the economy, I recommend this excellent Brookings article on inflation and financial inequality.

Don’t wait for the next crisis to realize you need a new money mindset. The dollar is changing. So should your strategy.